在现代金融体系中,硬币和加密货币这两者代表了两种截然不同的价值交换方式。硬币,作为有形的货币,自古以来...

Cryptocurrency has transformed the financial landscape since the inception of Bitcoin in 2009. With its rise, many individuals around the globe have begun to inquire whether owning cryptocurrency is becoming a common trend. The question 'Does everyone own cryptocurrency?' invites a nuanced discussion about the level of adoption, understanding of digital currencies, types of ownership, and the implications for the future of financial systems. This article will delve into the intricacies of cryptocurrency ownership, explore various perspectives, and address some of the common questions surrounding this topic.

Cryptocurrency ownership refers to the holding of digital currencies in a wallet—be it a software wallet, hardware wallet, or through exchanges. Unlike traditional currencies, cryptocurrencies are decentralized and operate on a technology called blockchain. This technology ensures transparency, security, and eliminates the need for intermediaries, such as banks. As the cryptocurrency market expands, the demographics of owners have also diversified, attracting not just tech enthusiasts but also mainstream investors and everyday individuals.

The question of whether 'everyone' owns cryptocurrency is multifaceted. While there is notable growth in ownership across various demographics, the global proportion of individuals who hold cryptocurrency remains relatively small. Studies and surveys indicate that, as of 2023, between 10% to 20% of the adult population in developed countries has some form of cryptocurrency investment. Meanwhile, in developing nations, this figure may be higher due to the need for alternative financial systems in regions with limited banking infrastructure.

People have varied reasons for investing in or using cryptocurrencies. These reasons can include:

Despite the allure of cryptocurrency ownership, several barriers inhibit widespread adoption. Here are some key challenges individuals face:

As the cryptocurrency ecosystem matures, various trends may influence future ownership patterns:

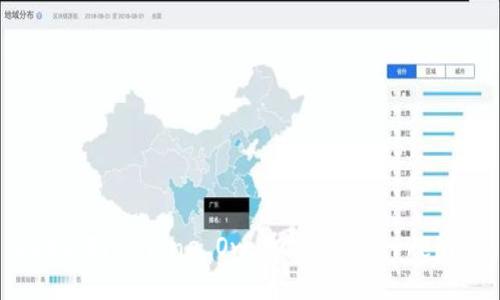

The demographics of cryptocurrency owners can provide insights into adoption trends. Research shows that younger individuals, particularly those aged 18 to 34, are more likely to invest in cryptocurrencies. This age group tends to be more technologically savvy and open to alternative financial solutions. Factors like income levels, education, and geographic location also play significant roles. For instance, urban residents with higher educational attainment and disposable income are more inclined to engage with the crypto market compared to their rural counterparts.

Moreover, surveys indicate a growing interest among women in cryptocurrency, although they still represent a smaller proportion of investors compared to men. Efforts to bridge this gender gap and educate potential female investors are emerging as important initiatives in the cryptocurrency space. Additionally, the increasing participation of older generations is noteworthy as they seek alternatives to traditional investments.

Investing in cryptocurrencies presents a unique set of risks. One primary risk is market volatility; cryptocurrencies can experience dramatic price swings that may lead to significant financial loss in a short period. While this volatility can attract speculative traders looking for quick profits, it can also devastate those with lower risk tolerance.

Another major concern is regulatory risk. Rapid developments in blockchain technology often outpace regulations, leading to uncertainty about legal frameworks and compliance requirements. For potential investors, erratic regulations across different jurisdictions can complicate ownership and trading.

Security risks present another layer of vulnerability for cryptocurrency holders. Hacks of exchanges and wallets can result in irreversible loss of funds. Moreover, the burden of self-custody—wherein users are solely responsible for their private keys—can be daunting, particularly for novices. In cases where users lose access to their wallets or fall victim to phishing schemes, their assets may be irretrievable.

As cryptocurrency ownership increases, its impact on traditional financial systems is becoming more pronounced. One significant effect is on monetary policy; with the emergence of decentralized currencies, central banks are compelled to consider how digital currencies might influence inflation, interest rates, and overall economic stability. For instance, extensive cryptocurrency adoption could diminish the efficacy of traditional monetary policy tools, leading central banks to rethink strategies.

Moreover, cryptocurrencies promote financial inclusivity, offering services to individuals without traditional banking access. In regions where banking infrastructure is lacking, cryptocurrencies allow people to engage in the economy, conduct transactions, and store value securely.

However, the rise of cryptocurrencies also presents challenges to compliance and regulatory oversight. Governments and regulatory bodies may need to develop frameworks to monitor transactions and prevent illicit activities, such as money laundering and fraud. The balance between innovation and regulatory control will shape how cryptocurrencies and traditional financial systems coexist and evolve in the future.

Securing cryptocurrency investments is paramount, given the digital nature and inherent risks of this asset class. There are several best practices individuals can employ to safeguard their holdings:

The future of cryptocurrency ownership is poised for growth, fueled by technological advancements and increasing acceptance across various sectors. As more individuals and businesses recognize the benefits of digital currencies, including ease of transactions, lower fees, and alternatives to inflationary fiat currencies, adoption rates are likely to rise.

Furthermore, educational initiatives aimed at demystifying blockchain technology and cryptocurrencies will play a crucial role in fostering wider interest and understanding. Schools, universities, and organizations may incorporate cryptocurrency-related content into curricula to prepare future generations for a digital economy.

Institutional support, evidenced by the entry of larger financial entities into the crypto space, can also catalyze growth. As traditional financial institutions develop custody solutions and innovative products linked to cryptocurrencies, consumer confidence in digital assets may rise.

In summary, while not everyone currently owns cryptocurrency, an increasing number of individuals may gravitate toward digital currencies as financial systems evolve and technology continues to advance. The journey of cryptocurrency ownership reflects broader trends in technology, finance, and personal empowerment, shaping the fabric of the future economy.